Most VCs are systematically terrible at recognizing patterns when it comes to women's health. Not because they're dumb – these are smart people. But because they fundamentally lack the lived experience to see what's staring them right in the face.

Madeline has grown into the role of an emerging manager, seasoned by her time as a consultant. Instead of going to a multi stage firm, Madeline chose to build something of her own.. To “zag when others zig”. And this makes sense when you peel back a layer, and get to know where she comes from.

She's one of 13 kids from a blended family in Australia, parents who met working at Domino's, moved to the US as a teenager, and watched her mother navigate chronic conditions within the Medicaid system.

"When we started to talk about GDP, we didn't account for work that was done at home, meaning if you are taking care of your aging mother. That does not account for GDP. Yet the moment that you get an outside care worker into the home now that's part of GDP."

Think about that for a second. We're measuring economic activity completely wrong, which means we're sizing markets wrong. No wonder most funds think women's health is niche when it's actually the majority of healthcare spending.

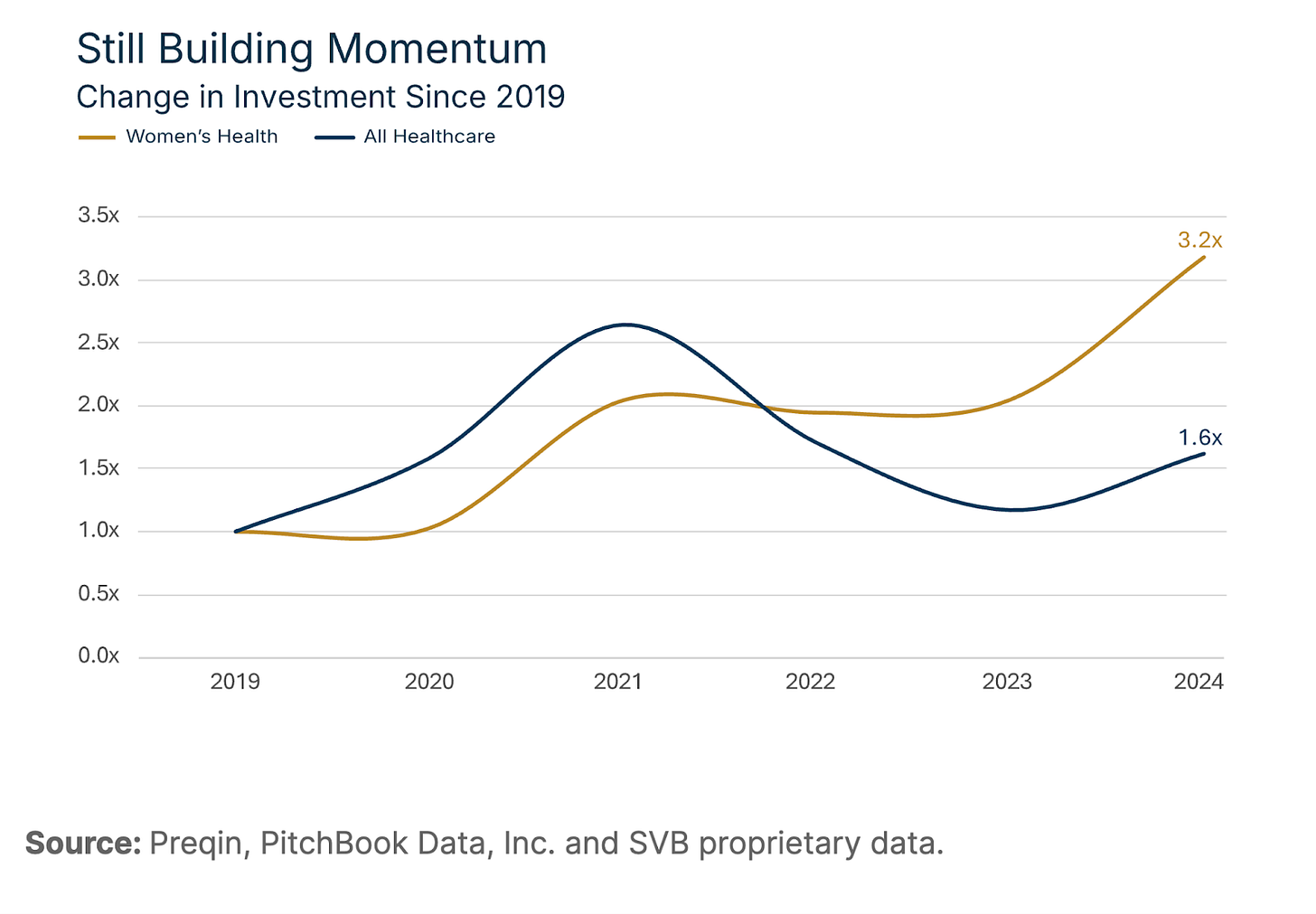

Investment in women's health companies increased 314% since 2018, while overall investment for the health sector increased 28%. (SVB’s Innovation in Women’s Health Report) Sounds impressive until you realize that's just catch-up from a ridiculously low baseline. The global FemTech market was estimated at USD 39.29 billion in 2024 and is expected to grow at a CAGR of 16.37% from 2025 to 2030, with some estimates suggesting it could reach USD 130.80 billion by 2034. (Research and Markets)

Madeline thinks even these numbers are conservative because they're based on the narrow definition of women's health that VCs love to box themselves into, and this is where Madeline’s thesis differs. While most funds are still stuck thinking about fertility apps and period trackers, she's looking at Alzheimer's, heart disease, osteoporosis – conditions that disproportionately affect women or affect them differently.

"70% of our healthcare is largely driven by chronic conditions. Women are living longer, which means they are more likely to be the caretaker of their spouse versus the other way around. They are more likely to be involved in end-of-life decisions. They are more likely to inherit financial decisions. And this is all part of health, too."

Suddenly you're not talking about a niche market. You're talking about the future of healthcare itself.

Here's where things get really interesting. Madeline's observed something that should make every LP pay attention: investors calling markets "saturated" after just 2-3 companies hit near-billion-dollar valuations. She digs deeper in her article with Forbes. "I have observed that the investor group tends to think things get saturated fairly quickly. So you might hear from many investors, 'Infertility is saturated. We now have 2-3 startups that have reached almost that billion-dollar mark. We're done.'"

Infertility. One of the most fundamentally human markets that exists. Saturated after three companies. The same thing is happening with menopause after companies like Flo Health ($200 million), Maven ($150 million) and Midi Health ($63 million) raised large rounds in 2024. These aren't saturation signals… they're proof of concept for much larger opportunities.

Her core investments span the care economy, pre-seed and seed stages, backing companies like Proov (infertility), Swehl (breastfeeding), Elektra Health (menopause), and Guaranteed (end-of-life hospice care). But it's her thesis that extends far beyond traditional women's health categories that makes her interesting.

Special thanks to Talal for the intro to Madeline.